Accelerating Gravity

Written by:

Patrick Boyaggi

Patrick Boyaggi

CEO an Co-Founder

Patrick is the Co-Founder and CEO of Own Up. He has a wealth of experience and knowledge as a mortgage executive.

See full bio

In the Winter of 2015, I began accepting applications for Raizlabs’ startup incubator, XLR8. The goal of this program was to help nurture the next great Boston area startups and provide them guidance in the areas that Raizlabs excels, namely mobile development, product management and UI/UX. We received a number of strong applications from companies working on businesses from craft spirit delivery to dating.

We also received an application from a Boston fintech startup called Own Up. They had no product, no service, only a hastily crafted pitch deck describing the arcane world of mortgages. Admittedly the XLR8 selection committee was not overwhelmed but we decided to give them a shot to pitch. The founders had solid backgrounds and a strong understanding of the industry they were tackling, the thing they lacked was exactly what Raizlabs was good at delivering.

The pitch to the team was compelling and the vision to disrupt the mortgage industry was exciting. They showed passion and knowledge and were eager to learn. The product began to take shape over the three months of the accelerator program and I offered to be their first customer if they could actually get me the best rate. I warned them that I had worked with a seasoned mortgage broker on previous transactions and I was fairly loyal to the relationship. Even though they were in my XLR8 program I was going to comparison shop for real.

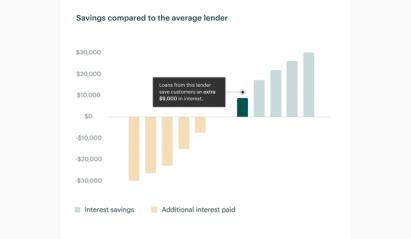

They went to work and by the conclusion of XLR8, they had received their license from the Mass Division of Banks and released an MVP. It was barebones, as is the nature of an MVP, but the Own Up team caught on pretty fast that it’s better to roll something out early and iterate than wait for the perfect product. I completed my application and I waited. The product wasn’t perfect but it did work. My wife and I then received rate quotes shortly after and I called my regular broker to compare. Sure enough I went back to my broker and her rate that was .375% higher than what Own Up was offering. No points, no closing costs, no gotchas. At first it seemed too good to be true, but they had explained to me how they secure lower rates by going direct to lenders. Let me sum it up:

Just refinanced with @Own Up. Saved $500/month and 15 years on my mortgage. Not bad for an MVP.

— Greg Raiz (@graiz) August 26, 2016

I subsequently had the opportunity to angel invest in the company, and chose to do so not because they had built an amazing piece of technology, but because the company was started by a team that understood a real problem, had the expertise to solve it and lived up to their product vision of saving me a lot of money. If you haven’t checked them out already, please do at ownup.com.