"It Seems Too Good to Be True, But Don't Be Skeptical"

Written by:

Patrick Boyaggi

Patrick Boyaggi

CEO an Co-Founder

Patrick is the Co-Founder and CEO of Own Up. He has a wealth of experience and knowledge as a mortgage executive.

See full bio

Allie and Kris were ready to buy their “forever home”, but due to their unique finances were having a hard time finding the 30-year fixed rate loan they had their minds set on. Until, that is, they worked with Own Up.

Here’s their story.

Allie and Kris were preparing to welcome their second child and were looking to buy a home that could work as their family grew. But because of their “complicated” income they weren’t having luck finding a competitive mortgage rate with their local bank.

Allie: “We owned a condo that we had turned into a rental property, and were looking to purchase a home nearby so it would be easy to upkeep it. Because of our income situation – at the time I was (and still am) working seasonally in a restaurant, and the rental property was fairly new – we were told that our income couldn’t be calculated in a way that banks would deem “trustworthy”. We didn’t have 2 years of tax returns for either so the best offer we were getting was a 7/1 ARM. We liked our local bank and had been working with them for years, but when we didn’t get an offer we were comfortable with we decided it was time to shop around.”

They reached out to Own Up after seeing an ad pop up on Facebook and started working with Patrick who analyzed their work history and income and leveraged their lender matching technology to find a lender that would accept their income and offer them the product they were looking for.

Kris: “Patrick helped us find a bank through their network of lenders that worked for our criteria and got us an offer for a 30-year fixed loan that we were thrilled about.”

Allie: “We were a little skeptical when we first reached out to Own Up. It seemed too good to be true. But Patrick was a godsend. He was available morning, noon, and night, at family outings, when he was with his kids! He was very hands-on, very approachable, very welcoming to our situation, and there for us whenever we needed anything. He thought about everything and was an incredible partner to us throughout the process.”

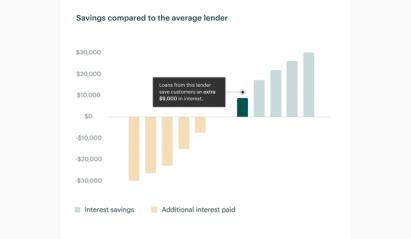

Kris and Allie say that the $17K they saved by the lower rate secured through Own Up was the difference between being able to put an offer in on their dream home and having to pass it up.

Kris: We knew we were looking for a home we would be in for years so the one we loved was definitely high on our budget. The initial loan we had gotten back from our local bank was just high enough that we wouldn’t have been able to make the finances work to move ahead on an offer. Getting that lower rate through Own Up brought this home back into our budget again. Realistically if we hadn’t gotten the loan rate change we wouldn’t have been able to get this home.”

Allie and Kris closed on their “forever home” – a colonial on 3.5 acres in Easton – in September, and say Own Up made the mortgage process the easiest part of their chaotic homebuying experience.

Allie: “The house ended up being on conservation land and there were lots of obstacles to go through with the actual purchase of the home. We had a 2-year-old and a baby due in January, and at the beginning of the process I had broken my leg so it was ultimate chaos. Having the mortgage approval process go through without a hitch was just amazing. It was one less thing to worry about.”

“Every single person we’ve had the opportunity to plug Own Up to we have. My uncles are buying a house, my cousins are looking to buy, my parents are looking to downsize their house, and everyone we’ve talked to we’ve been like ‘Go to Own Up! It’s not even worth looking anywhere else. It seems too good to be true but don’t be skeptical. It’s the real deal.’”

Ready to see how much you can save on your homebuying journey?