The Biggest Secret in Homeownership

Written by:

Own Up Staff

Own Up is a privately held, Boston-based fintech startup that is on a mission to make sure every home buyer receives a fair deal on their mortgage by unconditionally empowering individuals with customized data, personalized advice, and unprecedented access to mortgage lenders to create better financial outcomes and simplify the home financing experience.

See full bio

Chances are you’ve seen a lot of headlines about the red-hot housing market, historically low interest rates, or how homeownership in America will never be the same after COVID-19. We’re all trying to make sense of what the future holds, but there’s a story in home financing that isn’t making headlines, and we think it’s more important than any other. That story is about the massive difference in the cost of borrowing money to buy a home, for the exact same borrower, depending on where they get their mortgage.

Let's dive into the market spread of interest rates, what exactly that means, why that spread exists, and how you can avoid overpaying on the largest transaction of your life.

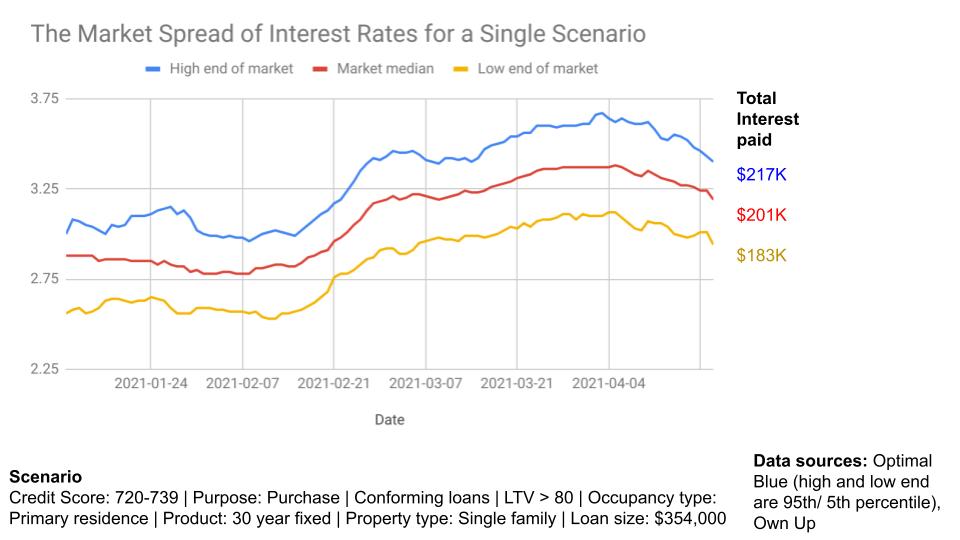

- The different colored lines represent the 95th, median, and 5th percentile of interest rates given for the same exact borrowing scenario over a ten-week period earlier this year. This is the spread of the market – the blue is the high end (high rates), the red is the median, and yellow is the low end (low rates).

- The total interest paid on the right-hand column shows what those different lines equal in terms of total interest paid on a $354,000 loan.

- For the borrower who got the median rate (the red line in the middle of the spread), they pay $18,000 extra over the term of the loan versus those who received a rate at the low end (the yellow line).

- For the unfortunate borrower who took a loan at the top end of the spread (the blue line), they hand over an extra $34,000 in interest vs the low end.

Borrowers are in the dark, some lenders like it that way

The simple explanation for why this spread exists is because borrowers don’t know about it. Another could be that they don't quite understand just how much the difference in pricing between lenders can cost them. Lenders have access to lots of information about what rates they should charge their borrowers, and borrowers have access to very little information about what a fair deal looks like for their particular scenario. That information asymmetry makes for uninformed borrowers who end up overpaying for their mortgage.

A mortgage is a mortgage – why are they priced so differently?

It’s important to remember that mortgage products are essentially a commodity. A 30-year fixed-rate loan is the same exact thing as any other 30-year fixed-rate loan, regardless of the lender or company that issues the loan. They are the same product sold by different lenders. Many lenders pride themselves on great service or being part of the community. Some mortgage companies sponsor sports arenas or buy Super Bowl ads, but the product they are selling is the same exact thing – cash. One lender's cash is just as green as the next.

Lenders have different business models...

Take the simplified analogy of a car dealership: If a car dealer wanted to sell as many cars as possible and beat the competition to earn market share, they’ll price their cars lower, and make a smaller profit on each sale. Alternatively, a different car dealer could decide they’re ok selling fewer cars, but they want to make a larger profit on each sale. This same principle applies to mortgage lenders and home loans.

...and different ideal borrowers

Lenders typically follow similar underwriting trends about who qualifies for a mortgage, but they evaluate borrower profiles differently. If you happen to be looking for a condo instead of a single family home, or in a certain zip code, or for a certain loan product, all of those factors get weighed in to the price of your loan. Some lenders have better pricing for certain borrower profiles and thus can offer better terms to those borrowers.

High stakes and tight timelines work against borrowers

As borrowers near the finish line of a long homebuying journey, they tend to focus on simply securing their purchase and getting approved for the mortgage. They can feel rushed or overwhelmed, or they can be relying on a trusted referral from a friend or a realtor or a big brand name. Mortgage shopping is cumbersome, time-consuming, and all the more challenging because of the barriers put in place by lenders, like long applications, hard credit checks, and deceptive advertising of too good to be true low rates that are only securable after being "bought down" by paying thousands of dollars upfront.

Technology levels the playing field

Innovation in auto, insurance, and real estate has shown that technology and transparent access to data can change the way people evaluate and ultimately make better choices. We built Own Up and tools like Lender Grader to bring the same benefits to homebuyers searching for a better mortgage.

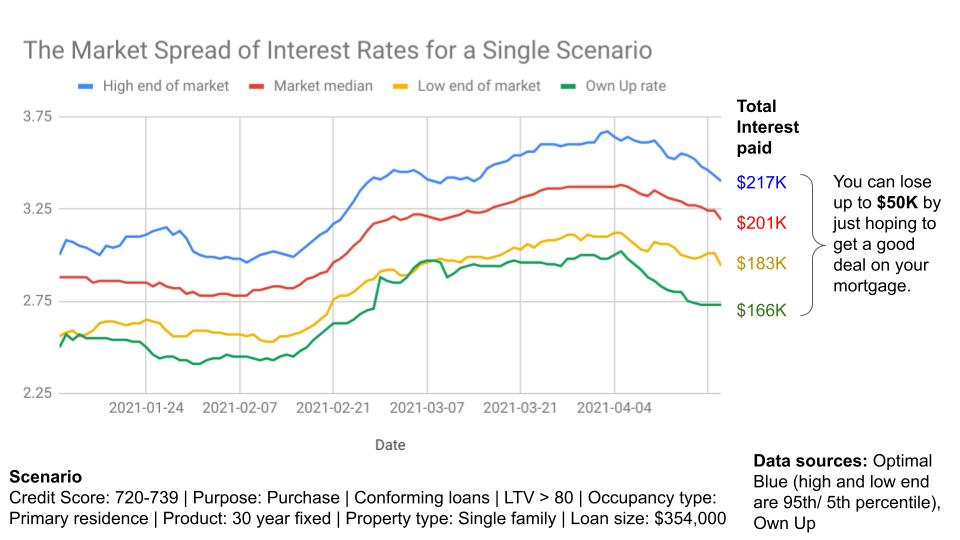

Own Up is built around the borrower, offering a painless comparison shopping experience for mortgages. We pre-negotiate pricing and use technology to cut costs within our marketplace of top local and national lenders to deliver market beating rates. After completing a short application process, our customers get detailed mortgage offers that are easy to compare side-by-side, or compare to the wider market – no hoops to jump through, like hard credit checks, spam, sales pressure or haggling to get the best deal. Here’s that same chart again, but with the best rate from the Own Up marketplace in green. We beat 90% of the offers in the market.

Our mission is to ensure everyone in America gets a fair deal on their mortgage. That doesn’t mean everyone in America gets a mortgage from Own Up, but that every homebuyer and homeowner understands what's at stake when it comes to the massive range of financial outcomes that depend on where they choose to get their mortgage. We're biased, but we think everyone should start, or end, their mortgage shopping process with Own Up. It's no risk and all reward.

Getting a single mortgage offer is a gamble – plain and simple. Don’t leave your mortgage rate to chance. The difference between getting lucky or unlucky could cost you as much as $50,000 in excess interest over the life of a $350,000 loan. Whether you want to think about that money as a year of college tuition, a fancy coffee every day for 30 years, or a chunk of retirement savings, you deserve to keep that money in your pocket. Shop around, compare offers, and take control of your mortgage.