Your Credit Score and Your Financial Well Being

Written by:

Frank Luisi

Frank is a VP at Own Up where he is responsible for business development and launching new products. He is a licensed property/casualty and title insurance producer.

See full bio

Fast Links

Every doctor’s visit starts with a blood pressure check. Why? Because your blood pressure is an overall measure of how well your body is working. Credit scores are a similar barometer for financial health. The higher your credit score, the more likely you are to get loans and once you achieve a certain score, the more likely you are to get them at a lower rate. Own Up uses technology to help people get a better rate on their mortgage. But we can only do this if clients meet minimum lending standards defined by the industry.

This can be hard these days as credit access tightened significantly after the great recession in the late 2000s. Before that crisis, median credit scores for purchased mortgages was 692. After the crisis, they increased over 20 points. A credit score below 620 will typically make obtaining a mortgage extremely difficult. A credit score over 700 is something to aspire to, while over 740 puts you in the top tiers.

If you are one of the people whose credit score is too low to qualify for a mortgage, we want to help you raise your score. Then we want to help you again when you are ready and able to purchase a home. As financially savvy former bankers, we can provide guidance on how to increase your credit score and realize your goal of home ownership.

The Lowdown on Credit Scores

Your credit score is a measure of your credit worthiness and helps lenders determine how likely you are to default on your loan. There is more than one way to calculate your credit score and many different companies that perform this task. FICO is one of the most well-known companies, but did you know there are 29 versions of the FICO score? Free credit score models like Credit Karma use other models including the vantage score by Vantage Score Solutions.

Mortgage companies typically rely on the FICO 2, 4 and 5 models, none of which are provided by free credit score companies. That said, Experian currently offers the FICO 8 model for free. While it is not identical to those used by lenders, it will provide the best free approximation.

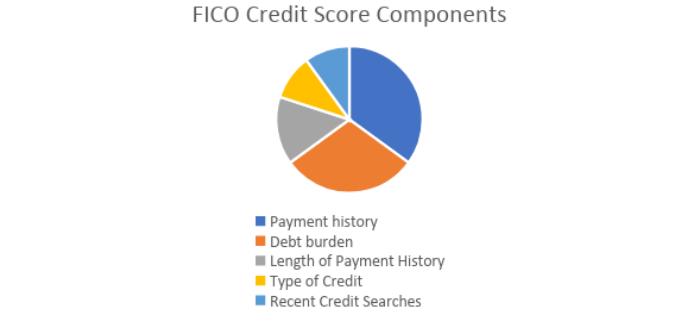

According to FICO, the score is broken up into five factors:

Together these components provide a sense of a consumer’s financial health. While payment history is the largest contributor to the credit score, debt is not far behind. This is good news for those looking to improve their credit score because any positive efforts to reduce debt will also impact payment history.

Improving Your Credit Score

There are two ways to improve your score: the DIY method and enlisting help.

Option 1: The DIY Method

- Make all your payments on time. This seems obvious, but any missed payments will set you back.

Own Up TIP: Set up email or text alerts with each creditor. - Analyze your credit usage. Get your credit report and look at each credit card. What percent of your credit limit are you using? The lower the utilization the better, so focus extra payments on the credit cards that have the highest utilization.

Own Up TIP: Find out when your credit card company reports to the credit bureaus and make your payments before that date regardless of the bill due date. Get your credit report to find out. - Don’t open or close credit card accounts. This will shorten your average account history length and could negatively impact your score.

- Check your report for errors. Credit bureaus are required to report accurate information and you are legally allowed to demand they investigate errors on your behalf.

Option 2: Enlist Help

There are numerous companies that can save you the frustration and confusion that comes with analyzing your credit report and working to improve your credit score. Depending on your individual situation, some consumers can see a positive change in as little as 30-60 days. But consumers need to know what they are getting into. Different companies have different terms and different prices. Below are three companies Own Up recommends.

- Pros: Good reviews; 90 day money back guarantee.

- Cons: More focused on disputing inaccurate information on your report and less focused on helping you budget to improve your score over time.

- Cost: Cheaper than other services at $60-$90 per month.

- Reviews of Credit Saint

- Pros: Can offer fast credit improvement; Open since 1991.

- Cons: Mixed reviews. More focused on disputing inaccurate information on your report and less focused on helping you budget to improve your score over time.

- Cost: Options range from $90 to 129 per month

- Reviews of Lexington Law

- Pros: Great Reviews; Nonprofit.

- Cons- More focused on debt management solutions that may involve debt negotiation or settlement. Debt negotiation or settlement can lower your credit score, but if you are having trouble making your current monthly payments, this may be your best option.

- Cost: Cheaper at $50 a month

- Reviews of Cambridge Credit Counseling

A Better Balance

A credit score is a snapshot over a certain period of time. This means that for every year that goes by things can change for the better. Negative events like missed payments, accounts sent to collections and bankruptcies generally stay on your record for about seven years.

But remember, the two biggest pieces of the credit pie are payment history and debt burden. These things are positively impacted each time you make payments on a debt and pay a bill on time. Becoming financially healthier will not only ease your stress, but put you one step closer to home ownership.